Updated 11.06.2024

Tax Rate Priorities

The VATRE, if passed by voters, would generate approximately $7 million in additional annual funding for the district, which would be allocated to the 2024-25 Compensation Plan, Version Two. VISD recognizes the pressing need to address the issue of staff compensation, which has lagged behind market rates for several years.

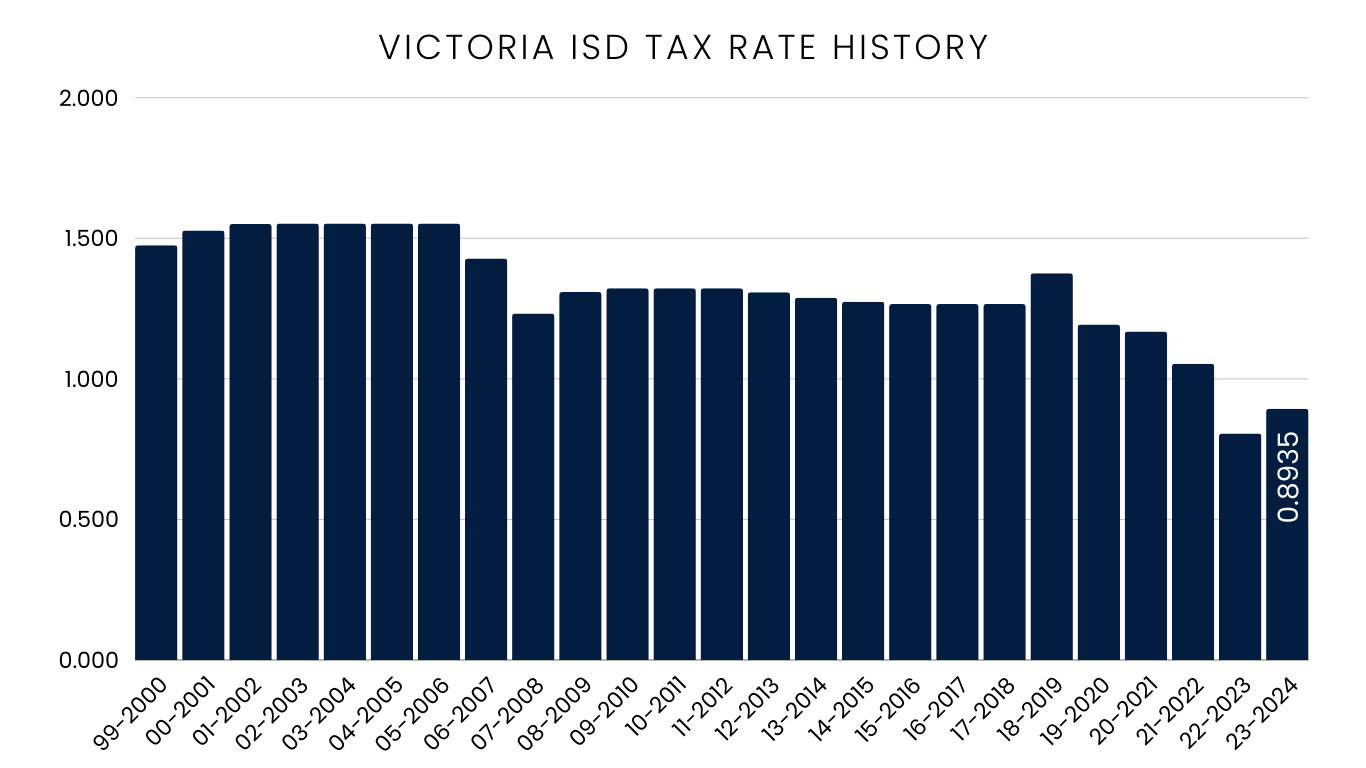

Tax Rate History

Victoria ISD's Board of Trustees approved the current maintenance and operations tax rate of $0.8935 per $100 of taxable property, which is among the lowest M&O rates to comparable districts and communities. Additionally, the district's 2023-2024 total tax rate of $0.8058 per $100 of taxable property was a decrease of 24.84 cents per $100 of taxed property value. This marks the district maintaining the lowest total tax rate in more than 30 years.

Area & Comparable District Tax Rates

Tax rates from 2023-24 are listed because of varying timelines to ratify tax rates):

Area Districts

Bloomington ISD: $0.9309

Calhoun ISD: $0.7949

Cuero ISD: $1.0022

Edna ISD: $08167

Goliad ISD: $1.0682

Hallettsville ISD: $0.8426

Industrial ISD: $0.9733

Yoakum ISD: $1.009

Average ISD: $0.903946

Victoria ISD: $0.8058

Comparable Districts

Bastrop ISD: $1.0702

East Central ISD: $0.8852

Duncanville ISD: $1.0828

Sheldon ISD: $1.2575

Sharyland ISD: $0.9575

Cleveland ISD: $1.0264

San Felipe-Del Rio CISD: $0.9386

Wichita Falls ISD: $1.1424

Average ISD: $1.02065

Victoria ISD: $0.8058

Community Input

We will record and make available all VATRE Community Meetings hosted by Victoria ISD>

Voter Information

The last day to Register to Vote is on Monday, Oct. 7, 2024.

The last day to Apply for a Ballot by Mail (Received, not Postmarked) is Friday, Oct. 25, 2024.

Early Voting begins Monday, Oct. 21, 2024, and ends on Friday, Nov. 1, 2024.

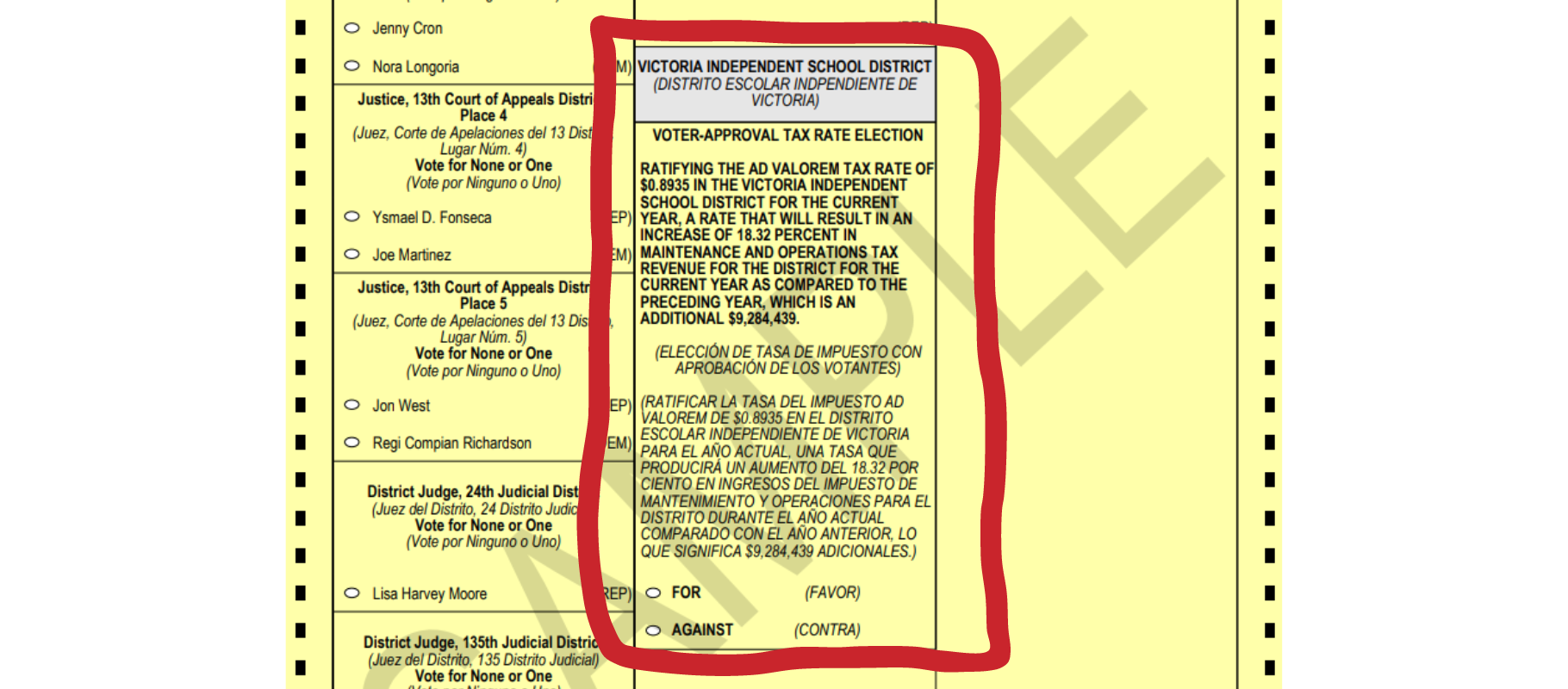

Sample Ballot

The voters of Victoria ISD will see the Voter-Approval Tax Rate Election item located as the last item on the ballot.

The 9-cent increase to the tax rate reflects a larger percentage of the total tax rate. You will see that 9 cents of an already low tax rate reflects an 18.32% increase.

The amount of $9,284,439 reflected on the ballot is due to additional revenues over last year due to state student funding allotments and the I&S rate which is reflected in the total tax rate for approval.

Check out these short informative videos about the 2024 VATRE for Victoria ISD!

What is a VATRE?

Why a VATRE?

Teacher and Staff pay

Voter Information

What is a VATRE?

State law requires that school districts seek voter approval to raise their tax rate above a prescribed amount. The election is referred to as a Voter-Approval Tax Rate Election, or VATRE.

Victoria ISD's VATRE asks voters to consider a 9-cent increase to the district's tax rate. In Texas, M&O budgets are used to fund daily operations, such as salaries, student programs, and utilities.

The state imposed a small tax compression this year moving the M&O rate down .0023%, or less than a quarter of a penny. With the District’s previously approved 8 golden pennies and the request for 9 copper pennies to fund Version 2 of the 2024-25 Compensation Plan, the adopted M&O tax rate will be $0.7869 per $100 of taxable value. The I&S, or the Debt Service rate will remain $0.1066 for a total tax rate of $0.8935 per $100 of assessed taxable value.

School boards are required to adopt the M&O rates provided by the state with the exception of any funds provided through "golden pennies/copper pennies" and/or approved by voters in a VATRE.